Practice Optimization Services

Your Practice Is a Business. Run It Like One.

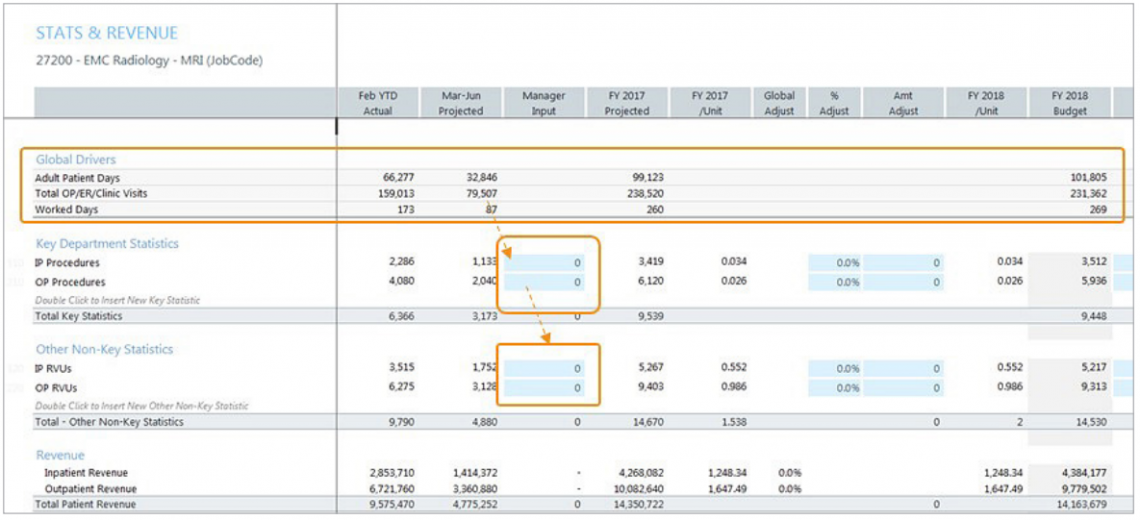

Create strong financial framework in which to run your business including timely financial forecasting / budgeting tools and reporting.

Utilize financial strategies to measure progress and efficiently manage operational workflows.

Create reporting that gives you answers / insight that you need:

Where should you focus your growth / investment?

How do we position you best for success now and in the future?

What are areas of risk that we need to proactively monitor / measure?

Optimization of Operations.

Review of your operations including advise on operational and human resource initiatives to manage / reduce your fixed costs and optimize marginal profitability of services.

Financial success in clinic based business isn't just about operational success but understanding what makes your practice bespoke.

How does your fixed cost basis compare against your competitors? Against the best version of yourself?

What are your unit economics by service? By payor type?

Actionable Insights.

Standing monthly review of performance against budget

In-depth analysis of financial & operational KPIs

Strategic advice to hit profit, utilization, and capacity goals.

We view your business as owners / operator not accountants.

For us the value of analysis is not in a pretty report but in how that reporting translates into improvements and cashflow.

AI-Powered Operational Integrations

We embed intelligent technology into your existing systems to streamline workflows and reduce overhead:

-

✅ Automated clinical note-taking

-

✅ Revenue Cycle Management (RCM) tools including:

-

Code validation & error detection

-

Prior auth tracking & alerts

-

Automated claim submission & appeals

-

Denial prevention and AR aging insights

-

-

✅ Compliance support for documentation and audits

-

✅ Operational checklists & AI-driven diagnostics